The insurance business is undergoing a significant transformation. As competition intensifies, customer expectations shift, and technology evolves, insurance companies are seeking innovative ways to motivate their agents, enhance performance, and boost customer satisfaction.

One strategy gaining traction is gamification. Gamification combines engaging game-like elements with real-world objectives to drive performance and engagement. But what exactly is gamification in insurance, and how can you implement it effectively in your organization?

This guide will cover everything you need to know about gamifying your agents and insurance company. Let’s dive in!

What Is Gamification in Insurance?

Gamification involves applying game-like elements—such as rewards, challenges, and competition—to non-gaming environments to drive engagement, motivation, and performance. In the insurance sector, gamification can revolutionize how agents work and interact with customers.

For instance, gamified tools can provide instant feedback on tasks, track progress, and celebrate milestones to create a sense of achievement. It transforms routine tasks into engaging activities, making agents more invested in their roles. Implementing personalized gamification strategies can further enhance agent engagement by aligning game elements with individual goals and behaviors.

Whether it’s improving sales performance or enhancing training sessions, gamification has the potential to make significant impacts.

Why Is Gamification Important for Insurance Companies?

The insurance industry is notoriously challenging. Agents often face high-pressure environments, repetitive tasks, and the need to consistently meet quotas. Gamification addresses these challenges by:

- Boosting Employee Motivation: Gamification taps into intrinsic and extrinsic motivators, making work more rewarding and enjoyable for agents.

- Enhancing Productivity: Engaged employees are 17% more productive, according to Gallup, which translates into measurable business results.

- Driving Learning and Retention: Training programs become more engaging and effective with gamified elements, encouraging agents to participate actively.

- Improving Customer Experience: Gamified platforms can make purchasing insurance or filing claims more interactive and satisfying for customers, fostering loyalty.

- Encouraging Innovation: With gamification, insurers can create an environment where agents feel encouraged to explore creative solutions.

Key Benefits of Gamification for Insurance Agents

1. Increased Motivation

Gamification leverages recognition, competition, and rewards to keep agents focused and driven. For example, leaderboards and badges celebrate achievements and create a sense of accomplishment. These elements encourage agents to consistently strive for excellence, thereby boosting sales team productivity.

Moreover, friendly competition can ignite a sense of urgency and engagement that traditional approaches often lack. This creates a workplace where achievements are celebrated, fostering a positive environment.

2. Better Training Outcomes

Insurance agents must understand complex policies and regulations. Gamified training modules use quizzes, levels, and real-time feedback to make learning enjoyable and memorable.

These modules can adapt to individual learning paces, ensuring every insurance agent grasps critical concepts. Additionally, rewards for completing training milestones incentivize continuous learning. As a result, agents feel more confident and capable in their roles, which positively impacts customer interactions.

3. Enhanced Collaboration

Friendly competitions and team-based challenges encourage collaboration and create a supportive environment among agents. When teams compete together, they learn to rely on each other’s strengths and develop camaraderie.

Collaborative goals also ensure that success isn’t just about individual achievements but about collective wins. This improves communication and builds a sense of unity within the organization. In the long term, such collaboration fosters a culture of shared success.

4. Data-Driven Insights

Gamification tools often integrate with CRMs and analytics platforms, providing actionable insights into agent performance and customer behavior. These insights enable managers to identify top performers and areas needing improvement. Additionally, gamified dashboards provide real-time metrics, empowering agents to track their own progress. Implementing a sales comparison dashboard can further enhance these insights by providing a visual representation of performance metrics.

This transparency builds trust and accountability, ensuring that everyone works towards the same goals. By analyzing this data, companies can refine their strategies to maximize impact.

5. Higher Retention Rates

Engaged employees are less likely to leave. Gamification fosters a sense of belonging and purpose, reducing turnover. When agents feel recognized and rewarded for their contributions, their job satisfaction increases.

Moreover, gamification can make daily tasks more enjoyable for sales employees, reducing stress and burnout. By creating a supportive and engaging workplace, insurance companies can build long-term loyalty among their employees.

How Insurance Companies Are Using Gamification

1. Sales Performance

Many insurance sales teams gamify sales processes by setting daily, weekly, or monthly goals for agents. Leaderboards and progress bars provide visibility into standings, while rewards like gift cards or bonuses motivate agents to hit their targets.

Gamification also introduces a sense of urgency and excitement that can help agents push through challenging periods. It allows managers to highlight top performers and inspire others to improve. By making sales goals more engaging, gamification transforms how agents approach their daily tasks.

2. Training and Onboarding

Interactive quizzes, scenarios, and levels make onboarding new agents more effective. Gamification also helps agents stay up-to-date on regulatory changes and product updates. For example, agents can earn points for completing training modules or answering quiz questions correctly.

These elements ensure that learning isn’t just a chore but an enjoyable process. Over time, gamified training builds a culture of continuous improvement and knowledge-sharing among agents.

3. Customer Engagement

Gamification isn’t limited to internal sales teams. Insurers use gamified apps to:

- Reward customers for healthy behaviors (e.g., steps tracked by fitness apps).

- Make filing claims less daunting with interactive guides.

- Incentivize policy renewals with loyalty programs.

These strategies create a more interactive and personalized customer experience. By engaging customers in fun and rewarding ways, insurers can foster stronger relationships and brand loyalty.

4. Claims Management

Gamifying claims processes can improve efficiency and customer satisfaction. For instance, agents can earn points for resolving claims quickly and accurately. This approach motivates agents to prioritize customer needs while maintaining high standards of accuracy.

It also reduces delays and bottlenecks in claims management. As a result, both customers and agents benefit from smoother processes.

5. Risk Assessment

Insurers gamify data collection by rewarding customers who provide accurate information or complete surveys. This improves underwriting accuracy and reduces fraud.

Additionally, gamification encourages policyholders to take proactive steps to minimize risks, such as attending safety workshops or maintaining their properties. By gamifying risk assessment, insurers can create more informed and engaged customer bases.

Gamification Strategies for Insurance Agents

Gamification strategies can be employed to motivate and engage insurance agents, leading to improved sales performance and customer satisfaction. Here are some effective gamification strategies for insurance agents:

- Leaderboards: Create leaderboards that rank insurance agents based on their sales performance, customer satisfaction, or other key performance indicators (KPIs). This fosters a sense of competition and encourages agents to strive for excellence. By seeing their names climb the ranks, agents are motivated to push harder and achieve more.

- Point Systems: Implement a point system that rewards agents for achieving specific goals or milestones. These points can be redeemed for prizes, bonuses, or other incentives. For example, agents could earn points for closing deals, attending training sessions, or receiving positive customer feedback. This system not only motivates agents but also provides a tangible way to recognize their efforts.

- Challenges: Design challenges that test agents’ knowledge, skills, and creativity. These challenges can be related to sales, customer service, or product knowledge. For instance, a challenge might involve creating the most innovative sales pitch or achieving the highest customer satisfaction score in a month. Challenges keep the work environment dynamic and engaging, encouraging agents to continuously improve.

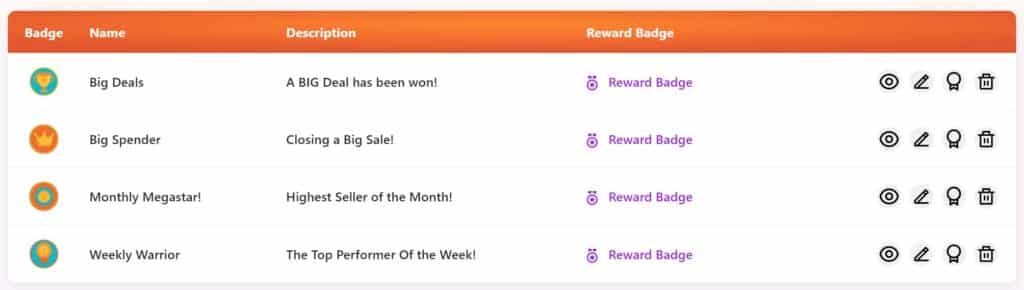

- Badges and Achievements: Award badges or achievements to agents who demonstrate exceptional performance or achieve specific goals. These badges can be displayed on their profiles or shared on social media. Recognizing achievements in this way not only boosts morale but also fosters a sense of pride and accomplishment among agents.

- Virtual Rewards: Offer virtual rewards, such as gift cards, vouchers, or exclusive access to events, to agents who achieve specific goals or milestones. These rewards provide immediate gratification and can be tailored to individual preferences, making them highly effective in motivating agents.

Challenges of Gamification in Insurance

1. Poor Implementation

Without clear objectives, gamification efforts can fall flat. It’s crucial to align gamification strategies with business goals.

For instance, poorly designed challenges may frustrate employees rather than motivate them. Clear communication about the purpose of gamification is key. Ensuring that tools are user-friendly and relevant is equally important to success.

2. Overemphasis on Competition

Excessive competition can harm team dynamics. Balance individual and team-based challenges to maintain harmony. Overly competitive environments can lead to stress and burnout, negatively impacting productivity.

By incorporating collaborative goals, insurers can foster a culture that values teamwork as much as individual success. A balanced approach ensures long-term sustainability of gamification strategies.

3. Data Privacy Concerns

Gamification tools often collect performance and customer data. Ensure compliance with privacy laws to avoid legal and reputational risks. Transparency about how data is used builds trust among employees and customers.

Implementing robust data protection measures is critical. This ensures that gamification enhances operations without compromising ethical standards.

4. Costs

Building a robust gamification platform requires investment. Evaluate ROI before implementing large-scale solutions.

Consider starting with scalable options that can grow as your needs evolve. Understanding the long-term benefits of gamification can help justify initial costs. Additionally, partnering with experienced vendors can streamline implementation and reduce unnecessary expenses.

Best Practices for Implementing Gamification in Insurance

1. Define Clear Objectives

Identify what you want to achieve: higher sales, improved training, better customer engagement, or all of the above. These objectives should align with broader business goals to ensure consistency. Clear goals also make it easier to measure success.

By defining objectives upfront, companies can design tailored gamification strategies that deliver tangible results.

2. Start Small

Pilot gamification initiatives with a small team to gather insights and refine your approach before scaling. This allows you to identify potential challenges and adjust strategies accordingly.

Piloting also helps build momentum and buy-in among employees. As you scale, lessons from the pilot phase can guide broader implementation efforts.

3. Choose the Right Tools

Select gamification platforms that integrate seamlessly with your existing systems, such as CRM and LMS. Compatibility reduces complexity and ensures a smoother rollout. Additionally, choose tools that are intuitive and user-friendly. This minimizes the learning curve and maximizes adoption rates among agents.

4. Involve Employees

Solicit feedback from agents to ensure the gamification strategy resonates with them. Employees who feel involved are more likely to embrace new initiatives. Regular feedback loops also help refine and improve gamification efforts over time. This collaborative approach fosters a sense of ownership and engagement.

5. Reward Meaningfully

Offer rewards that align with agent preferences, such as gift cards, extra time off, or recognition in team meetings. Meaningful rewards show agents that their efforts are valued. Tailoring rewards to individual preferences enhances their impact. Over time, this creates a culture of appreciation and recognition within the organization.

6. Monitor and Adapt

Continuously measure the effectiveness of your gamification initiatives and adjust as needed. Regular assessments help identify areas for improvement. By staying flexible, companies can ensure that their gamification strategies remain relevant and effective. Adapting to changing needs ensures long-term success and sustainability.

Metrics to Track Gamification Success

1. Sales Metrics

Monitor changes in conversion rates, upsells, and cross-sells. Increased sales figures indicate that gamification is positively impacting agent performance. By comparing pre- and post-implementation metrics, companies can measure ROI effectively. This data also helps refine sales strategies for maximum impact.

2. Training Engagement

Track completion rates, assessment scores, and time spent on training modules. High engagement rates indicate that agents find training more enjoyable and effective. Insights from these metrics can guide future training program designs. Continuous monitoring ensures that training remains impactful.

3. Employee Satisfaction

Use surveys to gauge whether gamification improves morale and engagement. Positive feedback from employees validates the effectiveness of gamification. Regular surveys also provide insights into areas needing improvement. Addressing employee concerns promptly ensures continued engagement and satisfaction.

4. Customer Feedback

Measure NPS (Net Promoter Score) and customer satisfaction ratings. Positive feedback from customers indicates that gamification is enhancing their experience. By monitoring these metrics, companies can identify trends and adjust their strategies accordingly. Satisfied customers are more likely to remain loyal and refer others.

5. Retention Rates

Analyze employee turnover rates to determine if gamification improves loyalty. Reduced turnover indicates higher job satisfaction and engagement among agents. These insights can guide broader retention strategies. Long-term retention benefits both employees and the organization.

Tools for Gamifying Insurance Companies

Here are some platforms commonly used to gamify insurance operations:

- Spinify: Boosts agent performance through customizable leaderboards and challenges.

- Bunchball: Offers gamification features for training and employee engagement.

- Axonify: Focuses on gamified learning for agents.

- Badgeville: Provides gamification tools for incentivizing behaviors.

- Centrical: Combines gamification with AI-driven insights to enhance productivity.

Is Gamification Right for Your Insurance Company?

Gamification can transform your business, but it’s not a one-size-fits-all solution. Consider these factors:

- Company Culture: Does your team value innovation and collaboration? Gamification thrives in environments that embrace change and creativity.

- Business Goals: Can gamification help you achieve your objectives? Aligning gamification with clear goals ensures measurable outcomes.

- Resources: Do you have the budget and technology to implement gamification effectively? Investing in the right tools and training is essential for success.

The Impact of Gamification in Insurance

Gamification in insurance is more than just a trend—it’s a powerful tool for driving engagement, productivity, and customer satisfaction.

By understanding its benefits, challenges, and best practices, you can create a gamification strategy that transforms your organization and sets your team up for success.

Start small, involve your agents, and continuously adapt your approach. With the right strategy and tools, gamification can help your insurance company thrive in today’s competitive landscape.